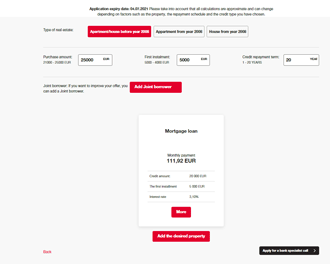

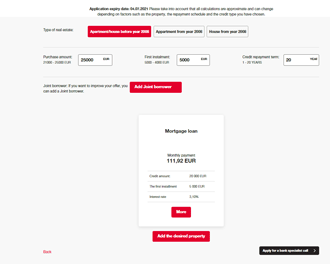

Provisional offer prepared

A provisional offer is prepared based on the information you submit to us initially.

It includes the loan amount available, the interest rate per year, and other relevant information. If you meet the criteria for any Altum programme, an Altum offer will also be included.

If the offer satisfies you, you can continue by entering the specific information about the property by selecting Add chosen property.

After you have entered information about the property and its valuation, a bank employee will evaluate your property valuation and prepare a second provisional offer for that specific property. Expect a call from the bank’s project manager about your offer.

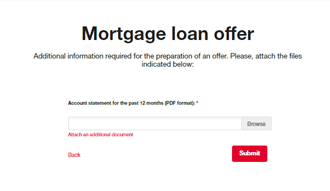

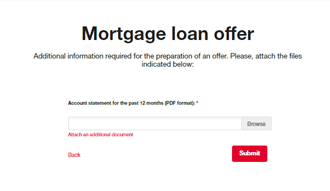

Submit additional documents

If, while preparing your offer, we discover that we need more detailed information about your income, your application will display the status “Add Document” along with an explanation of what documents are necessary to enable us to prepare an offer.

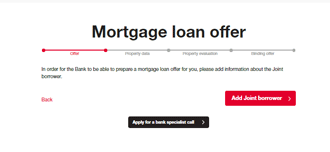

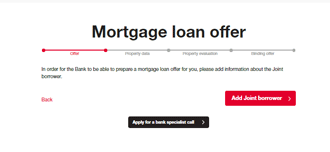

Add a co-borrower

There are times when you can only take out a mortgage loan with the help of a co-borrower. The co-borrower can be your spouse, partner, or other close person or relative.

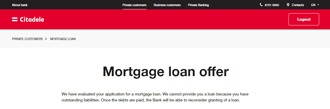

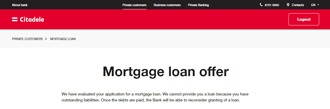

Application denied

There can be many reasons for a denial, the most common being outstanding loan payments or a loan balance which is too large to be able to take on a new loan.